Adding a Designated Partner to an LLP: Legal Requirements and Process

Introduction to Designated Partners in an LLP

A designated partner is a key individual in a Limited Liability Partnership (LLP) who is primarily responsible for compliance and governance under the LLP Act 2008. Adding a Designated Partner to an LLP becomes necessary when expanding operations, meeting statutory requirements, or strengthening compliance oversight.

Designated partners are similar to directors in a company and act as the main interface between the LLP and regulatory bodies. Every LLP must have at least two designated partners, who must be individuals, with at least one being a resident in India, as per the LLP Act.

Only individuals with a valid Designated Partner Identification Number (DPIN) can be appointed as designated partners. If an LLP fails to have the minimum required designated partners, all existing partners may be deemed designated partners and become responsible for statutory compliances.

Although LLPs provide limited liability, designated partners can be personally liable for penalties arising from non-compliance with statutory obligations. This highlights the importance of LLP compliance for Designated Partner, given their central role in governance, regulatory filings, and stakeholder communication.

When Does an LLP Need to Add a Designated PartnerAppointment of a designated partner is mandatory whenever it cannot meet the statutory minimum of two designated partners, including at least one resident in India, as required under the LLP Act, 2008. This situation typically arises on incorporation, on resignation/cessation of an existing designated partner, or when a partner is newly proposed to take on statutory compliance responsibilities.

Every LLP must have at least two designated partners, who must be individuals, with at least one being a resident in India. If at any time this minimum falls short due to resignation, death, disqualification, or change in residency status, the LLP must promptly appoint another designated partner to restore compliance.

If a vacancy in the office of designated partner occurs, the Designated Partner in LLP must be appointed within 30 days of such vacancy, failing which all partners may be treated as designated partners for compliance liability. Some practical guides also emphasize that delays can expose the LLP and partners to penalties, so the appointment should be done as early as possible within the prescribed period.

Apart from statutory breaches, it is advisable to add an additional designated partner when the LLP's size and compliance workload increase or when existing designated partners want to share statutory responsibilities. Many LLP agreements also provide for adding designated partners whenever there is a change in management, admission of a key partner, or requirement of a resident Indian to handle regulatory interfaces.

Eligibility Criteria for Becoming a Designated Partner

The following is the eligibility criteria for Designated Partner in LLP:

- Must be an individual (not a firm or LLP), though a body corporate partner may nominate an individual to act as its designated partner.

- Must be at least 18 years old and legally capable of entering into a contract.

- At least one designated partner in every LLP must be a resident in India, generally meaning a stay exceeding a prescribed number of days in the preceding financial year.

- Must not be an undischarged insolvent or have a recent history of insolvency or default to creditors.

- Must not have been convicted of an offense involving imprisonment beyond a prescribed period and must not be declared of unsound mind by a court.

For a designated partner appointment in India, documents are needed both from the individual being appointed and from the LLP for MCA filings.

Documents from the proposed designated partner:- PAN Card (for Indian nationals) and passport in case of foreign nationals, as primary identity proof.

- Recent address proof such as Aadhaar, voter ID, driving license, passport, bank statement, or utility bill not older than two months.

- Valid DIN/DPIN and a written consent to act as designated partner along with details of other directorships/partnerships, if any.

- LLP Form 4 filed on the MCA portal within 30 days of appointment, containing the new partner's particulars and duly digitally signed and certified by a practicing professional (CA/CS/CMA).

- LLP FORM 3, where required to record changes in the LLP agreement reflecting the appointment of the designated partner.

- Board/partner resolution or supplementary agreement approving the appointment, and any authorization or nomination letter if the partner is a nominee of a body corporate.

Adding a new statutory partner requires both internal (among partners) and statutory (under LLP Act and Rules) approval.

- Written consent of the incoming partner/designated partner to act in that capacity (usually in prescribed Form 9 under Rule 7/Rule 10 of LLP Rules, 2009). This document serves as the Consent of Designated Partner LLP.

- Verification by the incoming partner that they meet eligibility and are not disqualified under the LLP Act and the LLP Agreement.

- Consent of all existing partners for admission of a new partner, if the LLP Agreement is silent; otherwise, approval as per the specific authorization in the LLP Agreement (e.g., majority or designated partners).

- Passing of a partner(s)' resolution recording admission/appointment, noting the consent letter, and authorizing designated partners to complete MCA filings and execute amendments.

- Execution of a supplementary/amended LLP Agreement incorporating the new partner's name, contribution, and role, signed by the required partners as per the Agreement.

- Filing of LLP Form 4 (and LLP Form 3 where the Agreement is amended) with the MCA, containing a statement of consent by the new partner and certification by a practicing professional.

The LLP Agreement is central to governing how a designated partner is added, removed, or re-designated in an LLP. For the appointment of a designated partner, the Agreement operates alongside the LLP Act, 2008, and usually prevails for internal procedures where the Act is silent.

- Specifies the authority and process for admitting a new (designated) partner, such as unanimous consent or majority approval of existing partners.

- Lays down eligibility conditions, roles, duties, and contribution requirements for designated partners beyond the statutory minimum.

- Provides the mechanism for converting an existing partner into a designated partner and for rotation or sharing of the designation among partners.

- Requires execution of a supplementary/amended LLP Agreement whenever a new designated partner is added, recording their name, contribution, and profit-sharing ratio.

- Authorizes specific partners or designated partners to sign documents, digital filings, and forms for giving effect to the appointment with the Registrar.

- Acts as the primary reference in case of disputes about consent, approval thresholds, or rights of the newly added designated partner.

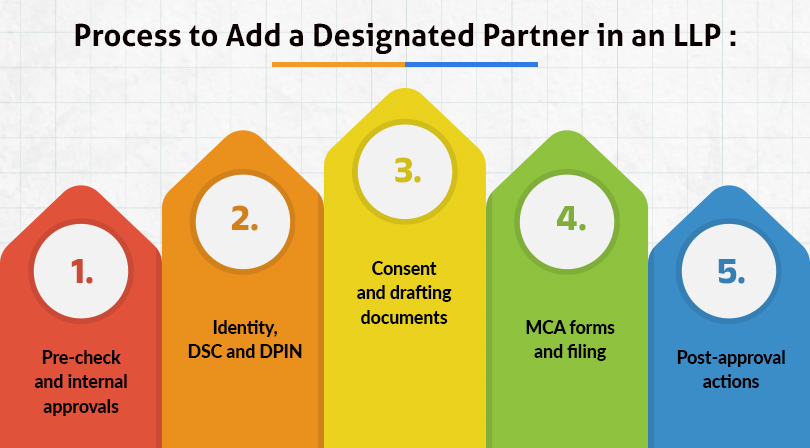

Step-by-Step Process to Add a Designated Partner in an LLP

Adding a designated partner in an LLP broadly follows a fixed, compliance-oriented sequence. The LLP Designated Partner process may vary slightly depending on the LLP Agreement and MCA updates, so applicable forms and timelines should always be verified on the MCA portal. The following is the MCA process for adding Designated Partner:

Pre-check and internal approvals:- Verify that the individual satisfies eligibility criteria (age, capacity, no disqualification, residency if required) and holds or will obtain DPIN.

- Review the LLP Agreement for clauses on admission/appointment of designated partners and obtain required partner approval (unanimous/majority as specified).

- Collect KYC documents (PAN/passport, address proof, photo, and contact details) from the proposed designated partner.

- Obtain/activate the individual's Digital Signature Certificate (DSC).

- Apply for and secure a DPIN/DIN if the individual does not already have one.

- Take written consent from the individual to act as a designated partner, in the prescribed format (commonly Form 9 or as per LLP Rules).

- Draft partner/LLP resolution approving the appointment and authorizing filling of forms and execution of a supplementary LLP agreement.

- Prepare a supplementary/amended LLP Agreement capturing the new designated partner's name, contribution, and rights/obligations.

- Fill and digitally sign LLP Form 4 with particulars of the new designated partner, attaching consent and relevant KYC/resolution documents.

- File LLP Form 3, where required, to register the amended LLP Agreement with the Registrar.

- Ensure both forms are filed within the prescribed time (generally 30 days from appointment) and certified by a practicing professional (CA/CS/CMA where mandated).

- Track MCA/ROC approval status and download updated master data once the appointment is taken on record.

- Update internal records, bank, PAN/GST, and other registrations, if necessary, to reflect the addition of the designated partner.

Appointment of Designated Partner in LLP India requires the following forms to be filled:

- Form 9: Written consent to act as designated partner obtained from the individual before appointment and kept as a key attachment/reference for filings.

- LLP Form 4: Primary e-form to intimate the appointment, cessation, or change in designation/particulars of partners or designated partners, to be filled on the MCA portal within the prescribed time (generally 30 days).

- LLP Form 3: Filed where LLP Agreement is amended to include the new designated partner's name, contribution, and rights/obligations, usually along with or shortly after Form 4.

- DIR 3 (or equivalent DIN/DPIN application): Used where the proposed designated partner does not already have a DIN/DPIN and needs one before being shown as a designated partner in LLP Form 4

- Internal resolutions and supplementary LLP Agreement (not MCA-numbered forms): Partner or LLP resolutions and the amended LLP Agreement, though not stand-alone MCA forms, are essential for LLP compliance for Designated Partner appointment and must be prepared and then attached or referred to in LLP Forms 3 and 4.

| Stage/item | Stage/item | Legal/Practical basis |

|---|---|---|

| Obtain DSC for proposed designated partner | Before filling any MCA form; preferably 1-3 working days in advance. | Required for signing e‑forms and documents; no fixed statutory day‑limit but needed pre‑filing. |

| Apply for DIN/DPIN (if not already available) | Before showing as designated partner in LLP records. | DIN/DPIN must exist prior to appointment recording; processing time depends on MCA workload. |

| Internal approval & consent (Form 9/letter) | Just before/at the date of appointment | Section 7 of LLP Act requires consent to act; taken on record as part of appointment documentation. |

| Effective date of appointment in LLP | As decided in resolution / supplementary LLP Agreement. | LLP Agreement and partner resolution fix the effective date from which duties commence. |

| Filing LLP Form 4 with ROC | Within 30 days of appointment date. | Section 25 read with LLP Rules; delay usually attracts additional fee per day of default. |

| Filing LLP Form 3 (amended LLP Agreement) | Generally within 30 days of execution of supplementary agreement. | LLP Act/Rules prescribe filing of changes in LLP Agreement within a fixed period (commonly 30 days). |

| LLP Act/Rules prescribe filing of changes in LLP Agreement within a fixed period (commonly 30 days). | As early as possible; no statutory cure window, only late fee | Forms can still be filed late but with continuous additional fee per day and possible penalties. |

| Replacement where vacancy arises (DP exits) | New designated partner to be appointed within 30 days of exit. | If not replaced within 30 days, all partners may be deemed designated partners for compliance. |

Common Mistakes to Avoid During the Appointment Process

Common errors during the appointment of a designated partner usually relate to eligibility, documentation, and MCA filings. Avoiding these early saves both penalizes and saves rework time.

- Not checking eligibility (insolvency, disqualification, residency, age, existing DIN/DPIN) before passing the appointment resolution.

- Proceeding without proper written consent from the incoming partner (Form 9/consent letter) and without consent of existing partners as required by the LLP Agreement.

- Incorrect or inconsistent KYC details: mismatch of name, PAN, DPIN, date of birth, or address between documents, LLP Agreement, and MCA records.

- Missing or wrong attachments in LLP Form 4 and Form 3 (no consent letter, incomplete resolution, unsigned or unstamped supplementary LLP Agreement).

- Forgetting to amend and file the revised LLP Agreement (Form 3) after adding the designated partner, leading to a mismatch between MCA records and the internal agreement.

- Using invalid/expired DSCs or filing with the wrong role (partner vs. professional), causing technical rejection of forms.

- Not updating capital contribution, profit sharing ratio, and role of the new designated partner clearly in resolutions, agreement, and books of account, creating future dispute risks.

Adding a designated partner to an LLP is not just a procedural formality; it is a governance decision that directly impacts the LLP's compliance health and risk profile. A structured approach—checking eligibility, securing clear consents, aligning with the LLP Agreement, and filling accurate forms within timelines—helps avoid penalties and future disputes. By paying attention to documentation, updating all statutory and internal records, and avoiding common errors, an LLP can onboard a designated partner smoothly while strengthening its management and regulatory credibility.

We assist LLPs in seamlessly adding or changing designated partners, from eligibility checks and drafting resolutions to filing Forms 3 and 4 and updating the LLP Agreement. With end to end professional support, we ensure full MCA compliance, error free documentation, and timely approval so you can focus on running your business.

Read Also:Frequently Asked Questions (FAQs) -

Q.1 Is it mandatory to have a designated partner in an LLP?Yes. Every LLP must have at least two designated partners who are individuals, and at least one of them must be a resident in India, as required under the LLP Act, 2008.

Q.2 When should an LLP appoint a new designated partner?A new designated partner must be appointed when the LLP falls below the statutory minimum, such as due to resignation, death, disqualification, or a change in the residency status of an existing designated partner.

Q.3 What is the time limit to appoint a designated partner after a vacancy arises?The LLP must appoint a new designated partner within 30 days of the vacancy.

Q.4 Can an existing partner be converted into a designated partner?Yes. An existing partner can be appointed as a designated partner, provided they meet the eligibility criteria and hold a valid DPIN.

Q.5 Is a DPIN mandatory for becoming a designated partner?Yes. A valid Designated Partner Identification Number (DPIN) is mandatory before an individual can be appointed and shown as a designated partner in MCA filings.