Close One Person Company (OPC) in India: MCA Rules and Compliance Guide

Introduction: Understanding OPC and Its Closure

A One Person Company (OPC) is a unique type of business structure introduced under the Companies Act 2013 to support individual entrepreneurs. It allows a single person to incorporate a company with limited liability, financial constraint, or a shift in business plans. However, there may come a time when the entrepreneur needs to close One Person Company due to financial constraints, restructuring plans, or inactivity. The Ministry of Corporate Affairs (MCA) in India has laid down specific procedures and compliance rules for closing an OPC. Understanding these legal provisions is essential to ensure a smooth and penalty-free exit from business operations.

Reasons to Close One Person Company in IndiaThere are several legitimate reasons why an entrepreneur may choose to close One Person Company. These can be both voluntary and compulsory in nature. Below are the most common reasons:

- Voluntary Closure: The sole member may decide to discontinue the business due to personal reasons, lack of profitability, or a change in career or business plan.

- Inactivity or Dormant Status: If the OPC has not commenced operations within one year of incorporation or has been inactive for two consecutive financial years, it may opt to close under the Fast Track Exit (FTE) scheme.

- Conversion into a Private or Public Company: An OPC is required to convert into a private limited company if its paid-up capital exceeds Rs 50 lakh or average annual turnover exceeds Rs 2 crore for three consecutive years. In such cases, closure of the OPC structure may be part of a strategic shift.

- Financial Constraints: If the OPC is under continuous financial stress, burdened with losses, or unable to meet operational costs, shutting down becomes a practical decision to avoid further liabilities.

- Non-Compliance or Legal Action: In some cases, the Registrar of Companies (ROC) may initiate action to strike off the OPC for failing to meet statutory compliance requirements like annual return filing, financial statements, or maintaining a registered office.

- Change in Business Model or Expansion Needs: When an entrepreneur plans to bring in more shareholders, raise funds, or restructure the company for growth, the OPC model may become restrictive, prompting its closure or conversion.

Types of OPC Strike-Off and Closure Options

To legally close One Person Company will depend on the business status, compliance history, and the intention behind the closure. Below are the main types of closure options available:

Voluntary Closure under Fast Track Exit (FTE) Scheme: This strategy is the most cost-effective mode of OPC strike-off for companies that are inactive. If the OPC has been inactive for two or more consecutive financial years, it can apply for closure through the Fast Track Exit mode as per Section 248(2) of the Companies Act, 2013. This is the quickest and most cost-effective option to close One Person Company for dormant or non-operational OPCs.

Strike Off by Registrar of Companies (ROC): The ROC can strike off an OPC suo moto under Section 248(1) if the company:

- Fails to commence business within one year of incorporation.

- Remains non-compliant for a long period.

- Does not carry out any business activity for two financial years and has not applied for dormant status.

- Voluntary Winding Up by Member: If the OPC is solvent and operational, but the owner wishes to shut it down for personal or strategic reasons, the company can opt for voluntary winding up by passing a special resolution and appointing a liquidator. This process for OPC closure in India is governed by the Insolvency and Bankruptcy Code (IBC), 2016, and the Companies (Winding Up) Rules, 2020.

- Closure through Conversion: Though not a direct closure, an OPC may choose to convert into a private or public company instead of dissolving. This is applicable when the OPC outgrows its structure and needs more flexibility for expansion or investment.

Know More About: One Person Company (OPC) Registration Services in Delhi India

Documents Required to Close an OPCFor legal OPC closure in India, the Ministry of Corporate Affairs requires submission of specific documents along with Form STK-2 (Application for Striking Off). The documentation ensures that the closure is voluntary, transparent, and compliant with the Companies Act, 2013.

Below is the list of essential documents required:

- A resolution by the sole member/director of the OPC approving the closure and authorizing the filing of Form STK-2.8

- A notarized affidavit from the sole director declaring: the company has no liabilities, the information provided is true and correct, and the company is not involved in any legal proceedings.

- A bond stating that the director shall indemnify any losses, liabilities, or legal issues that may arise even after the company is struck off.

- A certificate statement of accounts (not older than 30 days from the date of filing STK-2), showing no assets or liabilities. It must be verified by a chartered accountant.

- Personal identification documents of the director/member for verification purposes.

- If the company has creditors, a written NOC must be obtained and attached with the application.

- A certificate from the bank confirming the closure of the company’s bank account, if applicable.

- Filing the latest ITR helps establish financial transparency and tax compliance.

- An explicit letter stating the director’s consent to initiate and complete the closure process.

- The primary application form for striking off the OPC, filed with the ROC along with the above documents and a fee of Rs 10000.

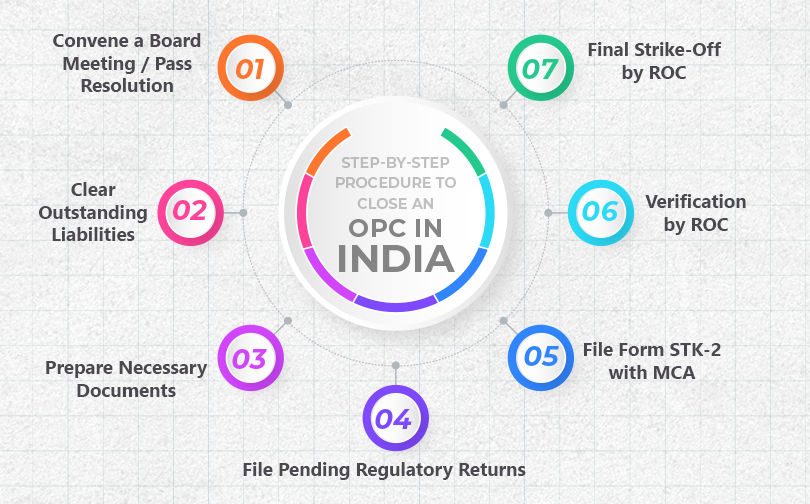

One Person Company closure in India involves following a defined procedure laid out by the Ministry of Corporate Affairs (MCA). Whether opting for voluntary strike-off or closure due to inactivity, it is important to comply with the legal steps to ensure a smooth and penalty-free exit.

- Convene a Board Meeting / Pass Resolution: As an OPC has only one member/director, a board resolution must be passed approving the closure and authorizing the filing of Form STK-2.

- Clear Outstanding Liabilities: Before applying for closure, ensure that all debts are settled, liabilities (if any) are cleared, and the bank account is closed.

- Prepare Necessary Documents: Gather and prepare the following documents: Affidavit in Form STK-4, Indemnity Bond in Form STK-3, Statement of Accounts (certified by a CA), PAN, Aadhaar, ITR copy, NOC from creditors (if applicable), Time Frame and Government Fees for Closure, and Tax and ROC Compliance Before Closure.

- File Pending Regulatory Returns: Ensure all Income Tax Returns and ROC filings (MCA annual returns) are up-to-date. Non-filing may result in rejection of the closure application.

- File Form STK-2 with MCA: Submit Form STK-2 online through the MCA portal along with the required documents and a filing fee of Rs 10000.

- Verification by ROC: The Registrar of Companies will verify the submitted documents, issue notices if clarifications are needed, and publish a notice of strike-off in the Official Gazette for public objection (if any).

- Final Strike-Off by ROC: If no objections are received within the stipulated time (usually 30 days), and everything is in order, the ROC will issue a notice of dissolution, and the OPC will be officially closed.

Know More About: Pvt Ltd Company Registration Services in Delhi India

Common Mistakes to Avoid During OPC Closure

To close One Person Company involves several legal and procedural steps. Overlooking even a small detail can lead to delays, rejection of your closure application, or even penalties. Below are some of the most common mistakes to avoid when closing an OPC:

- Failing to attach mandatory documents like the indemnity bond, affidavit, or NOC from creditors can lead to outright rejection of Form STK-2 by the Registrar of Companies (ROC).

- Submitting a statement of accounts older than 30 days from the date of filling the application is a common error. Always ensure the CA-certified accounts are recent and up-to-date.

- An OPC must not have any pending dues, loans, or liabilities at the time of applying for closure. The ROC will not approve closure if liabilities are reflected in the financials.

- If the company hasn’t filled its annual returns or financial statements, the closure request may be delayed or declined. Ensure all ROC filings are complete.

- Providing incorrect information or omitting material facts in the affidavit or indemnity bond can result in legal consequences, including fines or disqualification of the director.

- Once Form STK-2 is filed, a notice is published inviting objections from the public. Ignoring this step or assuming the company is closed before official confirmation can lead to misunderstandings or legal disputes.

- Forgetting to close the company's bank account is a common oversight. This could be seen as a sign that the business is still operational.

- Not consulting a chartered accountant or company secretary for final review can result in technical errors in the application, especially for statements of accounts and form filings.

To close One Person Company in India may seem like a complex process, but with proper planning and adherence to MCA regulations, it can be executed efficiently and legally. Whether you are closing due to inactivity, restructuring, or simply moving on to new ventures, it’s crucial to follow the correct procedure, starting from settling liabilities to filing Form STK-2 with complete documentation.

Taking the time to understand the One Person Company closure routes, avoid common mistakes, and stay compliant with tax and ROC filings will not only protect you from future liabilities but also preserve your credibility as an entrepreneur. Whether voluntary or initiated by ROC, an OPC strike-off must be handled carefully to ensure legal compliance and future credibility.

Start your business journey with ease and confidence. We offer seamless company registration services across India, providing the legal framework you need to grow. Our experienced legal experts will guide you through every step of the registration process for a smooth, hassle-free experience.

Read Also:Frequently Asked Questions (FAQs) –

Q.1 What is the meaning of an OPC strike off?OPC strike-off refers to the legal process of removing a One Person Company from the register maintained by the Registrar of Companies (ROC), effectively closing the business.

Q.2 When can a One Person Company be closed in India?A One Person Company can be closed voluntarily if inactive for two years or compulsorily if it fails to comply with statutory requirements.

Q.3 What is Form STK-2, and why is it required?Form STK-2 is the official form used to apply for the strike-off of a company under Section 248 of the Companies Act, 2013. It is mandatory for voluntarily closing an OPC.

Q.4 Is it necessary to file all pending returns before OPC closure?Yes, all pending ROC returns and Income Tax Returns must be filed before submitting the strike-off application to avoid rejection.

Q.5 How long does it take to close a One Person Company in India?If all documents are in order, the closure process generally takes 3 to 6 months, including the 30-day objection period after filing Form STK-2.