Understanding ROC Compliance Services: Meaning, Process, and Importance

Introduction to ROC Compliance Services

ROC compliance services refer to the essential legal and regulatory filings that companies in India must fulfil as per the Companies Act, 2013, monitored by the Registrar of Companies (ROC) under the Ministry of Corporate Affairs (MCA). These services help companies maintain transparency, legal standing, and operational integrity by ensuring timely submission of mandatory documents such as annual returns (Form MGT-7), financial statements (Form AOC-4), director KYC (Form DIR-3), and event-based disclosures like changes in directors or capital. A clear understanding of the ROC filing process helps companies ensure timely and accurate submission of these statutory documents.

ROC compliance is crucial for all registered entities, including private limited companies, public limited companies, LLPs, and Section 8 companies, as failure to comply can lead to monetary penalties, legal consequences, disqualifications of directors, or even company deregistration. Professional ROC compliance services typically offer end-to-end support, including company registration assistance, filling of annual and periodic returns, maintenance of statutory registers, board meeting documentation, and liaison with ROC authorities. These services are often provided by experts, such as chartered accountants or company secretaries, to help businesses avoid compliance risks and focus on growth.

What Is ROC Compliance?

ROC compliance in India is a legal framework that governs how companies must report their financial and operational information annually to the Registrar of Companies, a government authority under the Ministry of Corporate Affairs. The ROC oversees the registration, regulation, and compliance of companies and Limited Liability Partnerships (LLPs) under the Companies Act, 2013. ROC compliance involves regular filings of annual returns, financial statements, and event-based disclosures, such as changes in directors, capital, or the registered office. Among these, ROC annual return filing is one of the most significant statutory obligations for every registered company. The ROC filing process covers each of these submissions through structured electronic forms prescribed by the Ministry of Corporate Affairs.

It also requires companies to maintain statutory records and conduct board and shareholder meetings as per legal guidelines. These filings ensure transparency, accountability, and legal recognition of companies, protecting the interests of shareholders, creditors, and the public. Failure to comply with ROC regulations can lead to penalties, legal consequences, or disqualifications of directors. Thus, ROC compliance is essential for companies to maintain their good standing and operate smoothly within the Indian corporate regulatory framework. Engaging Reliable ROC compliance services ensures companies meet these obligations efficiently and on time.

Key Objectives of ROC Compliance- To regulate the formation, management, and dissolution of companies and LLPs, ensuring they operate within the law.

- To maintain accurate, up-to-date records and make key company information accessible to stakeholders and the public, promoting trust.

- To compel companies to file mandatory statutory returns, including annual returns and financial statements, preventing non-compliance and penalizing defaulters.

- To safeguard investors by ensuring companies disclose financial and operational information honestly and timely.

- To support good governance by monitoring board activities and changes in company structure and ensuring proper documentation and disclosures.

- By legally recognizing companies and enabling smooth, transparent business conduct with due legal documentation.

These objectives underline the importance of ROC compliance services in supporting legal and transparent company operations.

Major ROC Filings Every Company Must Know

Every company registered under the Companies Act must complete mandatory filings through a well-defined ROC filing process with the Registrar of Companies (ROC). Professional ROC compliance services help businesses manage these filings accurately and within deadlines.

- 1Annual Return (Form MGT-7): Filled annually to provide details on directors, shareholders, and shareholding patterns within 60 days of the Annual General Meeting (AGM).

- Financial Statements (Form AOC-4): Filled annually within 30 days of the AGM to submit audited financial statements, including balance sheets and profit & loss accounts.

- Director KYC (Form DIR-3 KYC): Directors must file this annually by September 30 to confirm their details and maintain Director Identification Number validity.

- Form DIR-12: For changes in directors, such as appointments, resignations, or changes in their details, and filed within 30 days of appointments, resignations, or changes in their details.

- Auditor Appointment (Form ADT-1): To notify the ROC about the appointment or reappointment of the statutory auditor during the AGM, and it must be filed within 15 days of the appointment.

- Return of Deposits (Form DPT-3): Annual return for money received that qualifies as deposits as per Companies Act requirements.

- Change in Registered Office (Form INC-22): Filed to notify ROC of changes in the company's registered office address.

- Event-based filings: Includes resolutions, charges creation/modification, and share allotments filed within stipulated timelines.

Know More About: Private Limited Company Annual Compliances Filing in India

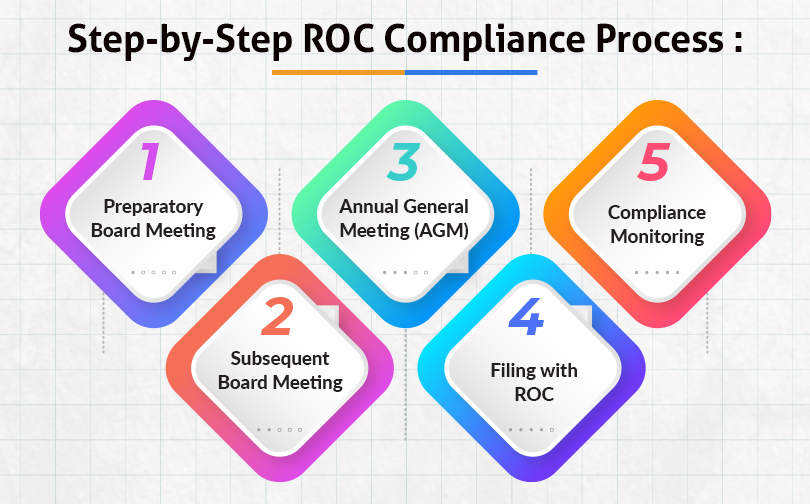

Step-by-Step ROC Filing Process –

- Preparatory Board Meeting: The Board of Directors authorizes the preparation of financial statements as per Schedule III, appoints auditors, and tasks the company secretary to prepare the Board's report and Annual Return.

- Subsequent Board Meeting: The draft financial statements, board’s report, and annual return are reviewed, approved, and finalized by the board to ensure accuracy and compliance.

- Annual General Meeting (AGM): The company holds its AGM, where shareholders approve the financial statements and the Board’s report and appoint or reappoint auditors.

- Filing with ROC: After the AGM, the company files mandatory forms online through the MCA portal. This step forms the core of the ROC filing process, ensuring that all annual and event-based forms are submitted within statutory timelines.

- Compliance Monitoring: Continuous monitoring to ensure timely filings and avoid penalties that include fines, disqualification of directors, and legal consequences.

Many businesses rely on ROC compliance services to streamline these steps, ensure accurate filing, and avoid penalties.

Documents Required for ROC Filing

- Audited Balance Sheet and Profit & Loss Account for the financial year.

- Auditor's report certifying the financial statements.

- The company's annual return, which includes details of shareholders, directors, and shareholding structure (for filing Form MGT-7).

- Details of loans, deposits, penalties, and liabilities, if applicable, for forms like DPT-3.

- List of Directors and Key Managerial Personnel (KMP).

- Appointment or reappointment letter of statutory auditors for Form ADT-1.

- Company documents like Memorandum of Association (MoA), Articles of Association (AoA), and other statutory records may also be referenced during filings.

- Director KYC documents for filing DIR-3 KYC, including personal and identification details of directors.

Importance of ROC Compliance for Companies

- ROC compliance ensures that a company maintains its lawful existence and active status on the Ministry of Corporate Affairs (MCA) portal, confirming its legitimacy to stakeholders and authorities.

- Timely ROC filings help companies avoid heavy penalties, fines, and legal prosecution imposed by the MCA for delayed or non-compliance, which can be financially burdensome.

- ROC compliance promotes transparency, accountability, and good corporate governance practices, fostering a culture of ethical operations within the company.

- By maintaining accurate records and filings, companies reduce the risk of fraud, malpractice, and director disqualification. Reliable ROC compliance services play a key role in maintaining this accuracy and transparency.

- They prepare necessary documents such as financial statements, annual returns, and board meeting minutes, and ensure timely electronic submission to the MCA portal.

- They manage and update statutory registers like the register of members, directors, and charges, which are crucial for compliance and audits.

- Professionals interpret legal provisions under the Companies Act, 2013, guiding the company on compliance deadlines and requirements to avoid penalties.

- They execute the entire process for annual filings such as financial statements and annual returns, ensuring accuracy and timeliness.

- Professionals stay updated on changing regulations and ensure the company complies with new requirements, thereby reducing legal risks.

- They act as the intermediary for communication and correspondence with ROC authorities related to compliance and filings.

Know More About: Annual Compliances Filing for OPC in India

Common Challenges in ROC Compliance

- Companies often struggle to file annual returns, financial statements, and other event-based forms within the strict deadlines, risking penalties.

- Collecting, organizing, and verifying extensive data needed for compliance reports is time-consuming and prone to errors.

- Small and medium enterprises (SMEs) may lack dedicated compliance teams or expert knowledge, making regulatory adherence challenging.

- Electronic filing through the MCA portal requires technical proficiency and digital signatures, which can be barriers for some companies.

- Non-compliance invites heavy fines, legal actions, director disqualification, and potential company deregistration, adding pressure to stay compliant.

- Increasing scrutiny and enforcement actions by MCA and ROC offices further raise compliance risks for companies.

Digitalization and the ROC e-Filing System

The digitalization of ROC compliance through the MCA e-filing system has revolutionized company law compliance in India. The Ministry of Corporate Affairs launched the MCA V3 portal, a fully web-based platform that streamlines compliance processes with real-time data validation, error prompts, and pre-filled forms. This shift from earlier offline PDF forms to integrated dashboards has improved user experience by offering role-based access, application tracking, and seamless digital submissions.

The portal also simplifies ROC annual return filing, enabling companies to submit annual data electronically without delays. Companies and professionals can now file essential documents like annual returns (MGT-7), financial statements (AOC-4), auditor forms (ADT-1), and director KYC (DIR-3) entirely online. The system supports digital signatures, reducing paperwork and facilitating faster acceptance by the ROC. Features such as compliance reminders, auto-validation tools, detailed status reports, and integration with statutory registers help maintain accuracy and timely filings.

This end-to-end digital filing ecosystem enhances transparency, minimizes manual errors, cuts processing times, and assures greater compliance adherence, thereby supporting good corporate governance and reducing legal risks for compliance operating in India. The move toward digital filing has simplified ROC compliance in India, making it easier for companies to meet legal timelines and maintain transparency.

Tips for Maintaining Ongoing ROC Compliance- Regularly monitor due dates for filing annual returns, financial statements, director KYC, and other statutory forms using compliance calendars.

- Keep all statutory registers, financial records, and resolutions properly maintained and ready for submission or review.

- Engage experienced company secretaries, CAs, or legal experts offering ROC compliance services to ensure filings are accurate and timely.

- Utilize MCA’s e-filing portal for smooth, paperless submission and to track the status of filings.

- Set internal compliance reminders well in advance of deadlines to avoid last-minute rushes or penalties.

- Conduct internal audits and review compliance status quarterly to identify gaps proactively.

- Educate your team on compliance requirements and procedural updates in MCA regulations.

Know More About: LLP Annual Compliances Filing in India

Conclusion

Adherence to ROC compliance is not just a legal obligation but a pillar for ensuring transparency, accountability, and good corporate governance in Indian companies. It safeguards a company’s legitimacy, enhances stakeholder trust, and minimizes risks of penalties, legal consequences, and director disqualifications. Timely and accurate ROC filings support smooth business operations, improve credibility with investors and financial institutions, and open avenues for growth and partnership opportunities.

Leveraging ROC compliance services and digital platforms enhances efficiency and helps companies focus on their core business objectives, making compliance a strategic asset for sustainable success in India's dynamic corporate environment. By following proper ROC compliance in India, businesses can avoid penalties and maintain good standing with regulatory authorities. Timely ROC annual return filing ensures that companies remain transparent, compliant, and legally active under the Companies Act, 2013.

We provide expert ROC compliance services to ensure your business meets all statutory requirements under the Companies Act, 2013. From annual filings like MGT-7 and AOC-4 to director KYC and event-based submissions, our comprehensive support guarantees 100% compliance, timely submissions, and peace of mind. Partner with us to avoid penalties, maintain corporate governance, and focus on your business growth confidently.

Read Also:Frequently Asked Questions (FAQs) –

Q.1 What is ROC compliance?ROC compliance refers to the process through which companies registered under the Companies Act, 2013, submit their annual returns, financial statements, and other statutory documents to the Registrar of Companies (ROC) to maintain legal standing.

Q.2 Why is ROC compliance important for companies?It ensures transparency, builds investor confidence, and helps companies avoid penalties or legal action.

Q.3 Who can help with ROC compliance services?Companies often seek assistance from chartered accountants, company secretaries, or legal professionals who specialize in ROC filings and compliance management.

Q.4 How can a company ensure continuous ROC compliance?Maintain accurate financial records, keep track of statutory deadlines, and consult compliance experts regularly to avoid delays or errors in filings.

Q.5 What happens if a company fails to comply with ROC filing requirements?Non-compliance can attract heavy penalties and late fees and may result in the company being marked as inactive or struck off by the ROC.