DIR-3 KYC Form: Complete Guide for Directors in India

What is the DIR-3 KYC Form

DIR-3 KYC is an electronic Director KYC form mandated by the Ministry of Corporate Affairs (MCA) for the annual KYC (Know Your Customer) verification of directors holding a valid Director Identification Number (DIN) in India. This initiative strengthens MCA KYC compliance for directors, ensuring transparency and preventing misuse of DINs.

All directors who have been allotted DIN on or before the end of the previous financial year, and whose DIN status is ‘Approved’, must file the DIR-3 KYC form every year by the 30th of September. The form collects essential data, including name, date of birth, address, contact number, email ID (verified by OTP), nationality, and ID proofs, which are validated with supporting documents. Non-compliance leads to deactivation of the DIN and a penalty for late filing.

Who Needs to File the DIR-3 KYC Form

Every individual who has been allotted a Director Identification Number on or before March 31st of a financial year, regardless of whether they are currently a director or designated partner in any company or LLP, must file the Director KYC form annually by September 30th of the following financial year. The requirement applies whether the DIN is in ‘Approved’ or ‘Disqualified’ status, and even if the individual is not actively serving as a director or partner.

Designated partners in LLPs holding DPIN (which is treated as a DIN) are also required to comply. Individuals who receive a DIN after March 31st are exempt from filling for that year and must file KYC by the next September. Non-compliance leads to deactivation of DIN, restricting one’s eligibility to act as a director until filing is completed with a penalty. Both Indian nationals and foreign directors holding DINs must comply.

Types of DIR-3 KYC Forms (DIR-3 KYC and DIR-3 KYC-WEB)

The MCA has introduced two modes of the Director KYC form – DIR-3 KYC eForm and DIR-3 KYC-WEB. Both the eForm and web-based KYC options fulfil the annual requirement of MCA KYC compliance for directors.

|

Form Type |

Purpose |

Documents Required |

DSC Required |

Notes |

|

DIR-3 KYC eForm |

First-time filing or updates |

PAN, Aadhaar/Passport, Address Proof, Professional Certification |

Yes |

Comprehensive filing, must be certified by CA/CS/CMA |

|

DIR-3 KYC-WEB |

Annual filing if details remain unchanged |

None (OTP verification only) |

No |

Simplified, quick OTP-based process |

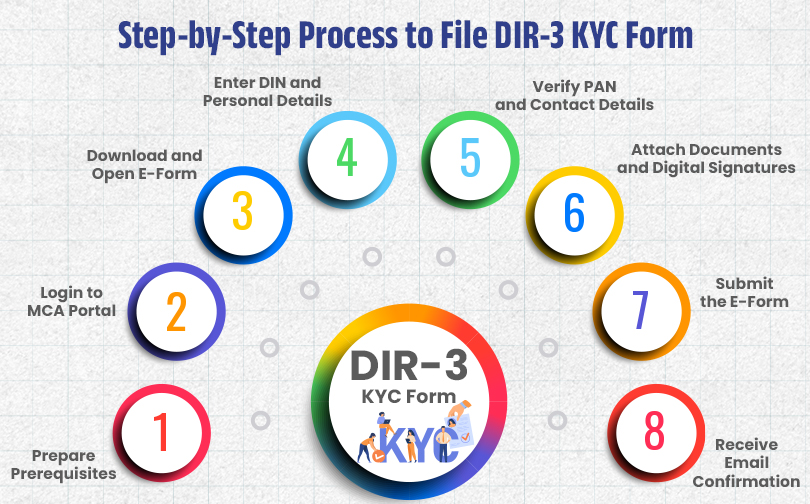

Step-by-Step Process for DIR-3 KYC Filing

To file the DIR-3 KYC Form e-form, directors must follow a structured online process through the MCA portal, ensuring details and documents are correctly uploaded and validated. Here are the step-by-step instructions to be followed for DIR-3 KYC filing:

- Prepare Prerequisites: Obtain a valid Digital Signature Certificate (DSC) and gather necessary documents, including PAN, Aadhaar/passport, proof of address, email, and mobile number.

- Login to MCA Portal: Access the MCA website and log in with credentials or register if new.

- Download and Open eForm: Go to 'MCA Services' > 'Company e-Filing' > 'DIN Related Filings' > 'Form DIR-3 KYC' and download the form.

- Enter DIN and Personal Details: Input DIN, full name (as per PAN), father’s name, nationality, date of birth, permanent and current address (with proof), email ID, and mobile.

- Verify PAN and Contact Details: Validate PAN via the 'Verify Income-Tax PAN' button and verify mobile/email via OTPs sent during form filling.

- Attach Documents and Digital Signatures: Upload scanned copies of intensity and address proofs, self-attested. The director must sign the form using their DSC, and the form must also be digitally signed by a practising CA, CS, or Cost Accountant.

- Submit the eForm: After verifying all entries and signatures, click ‘Submit’. Upon successful submission, a Service Request Number (SRN) is generated for future MCA correspondence.

- Receive Email Confirmation: An acknowledgement email will confirm successful filing.

Know More About: LLP Registration Services

Following these above steps ensures smooth filing and adherence to MCA KYC compliance for directors under Companies Act requirements.

Documents Required for DIR-3 KYC Filing

The documents required for filling the Form DIR-3 KYC are intended to verify the identity, address, and contact details of the director as per Ministry of Corporate Affairs (MCA) guidelines.

The following documents are mandatory for filing the Director KYC form with MCA:

|

Document Type |

Details |

|

PAN Card |

Mandatory for Indian nationals (self-attested) |

|

Aadhaar Card |

Used as ID and address proof |

|

Passport |

Mandatory for foreign directors; optional for Indian directors |

|

Address Proof |

Voter ID, Driving License, Utility Bill, Passport, Aadhaar |

|

Mobile & Email |

Verified via OTP |

|

Digital Signature Certificate (DSC) |

Class 3 DSC based on PAN |

|

Professional Certification |

Form must be certified by CA, CS, or CMA |

DIR-3 KYC Due Date & Late Fees

|

Filing Period |

Fee / Penalty |

|

On or before 30th September |

No fee |

|

21st September – 5th October |

Rs. 500 (DIN deactivated due to non-filing) |

|

6th October onwards |

Rs. 5000 |

Consequences of Not Filing the DIR-3 KYC Form

Failure to file MCA DIR-3 KYC by the due date results in immediate deactivation of the Director Identification Number (DIN) by the Ministry of Corporate Affairs. This disables the individual’s legal authority to act as a director, meaning they cannot sign MCA forms, be appointed, or resign from directorship roles in any company.

To reactivate the DIN, the director must complete the KYC filing and pay a mandatory late penalty fee. This fee is non-negotiable and must be paid even if there was an unintentional delay. Non-compliance can disrupt company operations, causing delays in signing statutory documents, filing annual returns, or making board-level decisions, thus risking further penalties and regulatory scrutiny.

Repeated failure or prolonged non-compliance may lead to disqualification from current and future directorships and can attract higher penalties as specified under the Companies Act and relevant MCA rules.

Common Mistakes to Avoid While Filing DIR-3 KYC

Directors frequently make several errors during DIR-3 KYC filing, which can cause form rejection, delays, penalties, or DIN deactivation.

Common mistakes to avoid:

- Failing to file by 30th September leads to DIN deactivation and a penalty.

- Submitting DIR-3 KYC-WEB instead of the eForm if you are a first-time filer, updating details, or reactivating a deactivated DIN results in rejection.

- Errors in PAN, Aadhaar, name, or address—details must precisely match official documents and the MCA database.

- Attempting to file using an expired or unlinked Digital Signature Certificate prevents submission.

- Forgetting to upload clear, recent, self-attested copies of PAN, Aadhaar, passport-sized photos and address proof causes rejection.

- Differences between PAN and MCA records trigger validation failures; update discrepancies with the DIR-6 form before filling.

- Not getting an eForm certified by a practising CA, CS, or CMA leads to non-compliance.

- Missing OTPs on mobile/email in web-based KYC results in incomplete filing.

- Not updating MCA records with new contact or address details leads to communications failures and non-receipt of OTPs.

Know More About: Private Limited Company Closure in India: Winding Up Process and Compliance

How to Check DIR-3 KYC Status Online

The DIR-3 KYC status can be checked online through the MCA portal by following these simple steps:

- Visit MCA Portal: Go to the official Ministry of Corporate Affairs website at https://www.mca.gov.in/.

- Login/Register: Log in using your registered MCA username and password, or sign up if new.

- Navigate to Services: From the dashboard, click on ‘MCA Services’ > ‘DIN Services’ > ‘DIR-3 KYC’ or ‘DIR-3-KYC-WEB’.

- Enter DIN Details: Input the Director Identification Number (DIN) whose KYC status you wish to check.

- View Status: The system immediately displays the current KYC status of the DIN. If successful, you’ll see “Director KYC already done for this year”. If not completed, you will be prompted to complete the process.

Conclusion: The Importance of Timely DIR-3 KYC Filing

Timely filling of the DIR-3 KYC form is crucial for directors to maintain their Director Identification Number in active status and stay compliant with Ministry of Corporate Affairs regulations. Filing by the deadline of 30th September ensures zero government fees and smooth continuation of directorship duties.

Missing this deadline leads to immediate deactivation of the DIN, disabling the director’s legal authority to sign official documents or act as a director in any company until reactivation. Reactivation requires filling the form late along with a mandatory penalty.

An active DIN is essential for seamless company operations, including timely filing of annual reports and board resolutions. Delays due to DIN deactivation can disrupt compliance and corporate governance, risking further legal and financial penalties.

Directors should treat timely filing as a priority to maintain active DIN status and meet MCA KYC compliance for directors.

Enhance your business opportunities with our expert company registration services. We ensure a seamless process, quick approvals, and comprehensive support to meet all regulatory requirements.

Read Also:

How to Change a Company Director?

Frequently Asked Questions (FAQs)

Q.1 What is the DIR-3 KYC form?

The DIR-3 KYC form is a mandatory filing introduced by the Ministry of Corporate Affairs (MCA) for directors who hold a valid DIN (Director Identification Number). It ensures updated personal details for directors in MCA records.

Q.2 Who needs to file the DIR-3 KYC form?

Every individual holding a DIN, whether active in a company/LLP or not, must file the DIR-3 KYC annually before the due date.

Q.3 What is the due date for DIR-3 KYC filing?

Generally, the due date is 30th September of every financial year. However, MCA may extend deadlines through official notifications.

Q.4 Is DIR-3 KYC filing required every year?

Yes, directors must update their KYC details with MCA annually, even if there are no changes in their personal details.

Q.5 How can I check the status of my DIR-3 KYC filing?

You can check the DIN status on the MCA portal. If successfully filed, the DIN will show as “Approved” and “Active”.