Private Limited Company Closure in India: Winding Up Process and Compliance

Introduction to Private Limited Company Closure:

A Private Limited Company Closure in India is a formal legal process to end the existence of a company registered under the Companies Act of India. This step is taken when a business is inactive or financially unviable, or the promoters wish to avoid ongoing compliance costs and future liabilities. The closure of a company under the Companies Act 2013 can be carried out through compulsory winding up, voluntary winding up, or strike-off procedures.

The company winding-up process involves passing a resolution in a general meeting with the consent of shareholders and directors, settling all debts and liabilities, surrendering any government registrations, and submitting necessary filings and applications to the Registrar of Companies (ROC). Once closure is approved, the company ceases to exist in the eyes of the law, freeing directors and shareholders from future obligations related to that company. Proper closure ensures compliance with legal requirements, prevents further penalties, and allows stakeholders to pursue new business opportunities.

Reasons for Private Limited Company Closure in India under the Companies Act 2013:Here are the main reasons for Private Limited Company Closure in India:

- Persistent financial losses or insolvency make continued operations unviable for directors and shareholders.

- Outdated or unsustainable business model resulting from changing market conditions or technological advancements.

- Evolving business objectives or a strategic shift, such as pursuing new ventures or restructuring the organization.

- Internal conflicts among shareholders or directors that hinder day-to-day operations and decision-making.

- Retirement, succession issues, or significant changes in the personal circumstances of key decision-makers.

- Non-compliance with legal and regulatory requirements, risking disqualification, penalties, and prosecution.

- The company has been inactive or dormant for an extended period, making compliance unnecessary and burdensome.

- Insufficient number of members or inability to meet statutory requirements.

- Failure to file financial accounts or annual returns for several consecutive years.

- Achievement or expiration of the company’s original objective, meaning its purpose is fulfilled or no longer relevant.

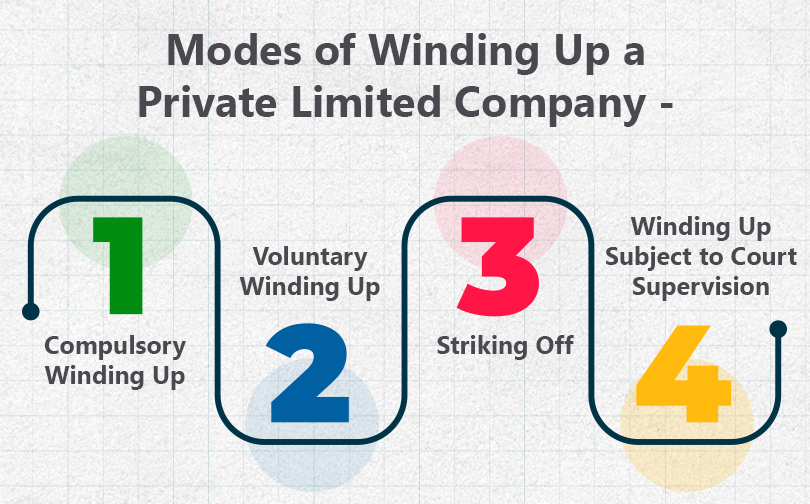

Modes of Winding Up a Private Limited Company:

The following are modes of Private Limited Company Closure in India:

- Compulsory Winding Up: This occurs when the National Company Law Tribunal (NCLT) orders the closure of the company due to insolvency, fraudulent activities, or legal violations. The process is managed by an official liquidator and is typically initiated by creditors, the government, or other stakeholders.

- Voluntary Winding Up: This mode is initiated by the company’s shareholders if the business is solvent or by creditors if it is insolvent. It starts with a formal resolution, followed by the appointment of a liquidator who oversees asset liquidation and debt repayment, all without court intervention.

- Striking Off: Another method is the Strike Off Private Limited Company procedure, which is simpler and quicker for defunct businesses. A defunct or dormant company that has not commenced business or has been inactive for two consecutive financial years can be removed from the Register of Companies by the Registrar upon application in Form STK-2. This is a faster process intended for companies that have no assets or liabilities.

These modes help companies close down in accordance with statutory procedures and protect stakeholder rights during liquidation or dissolution.

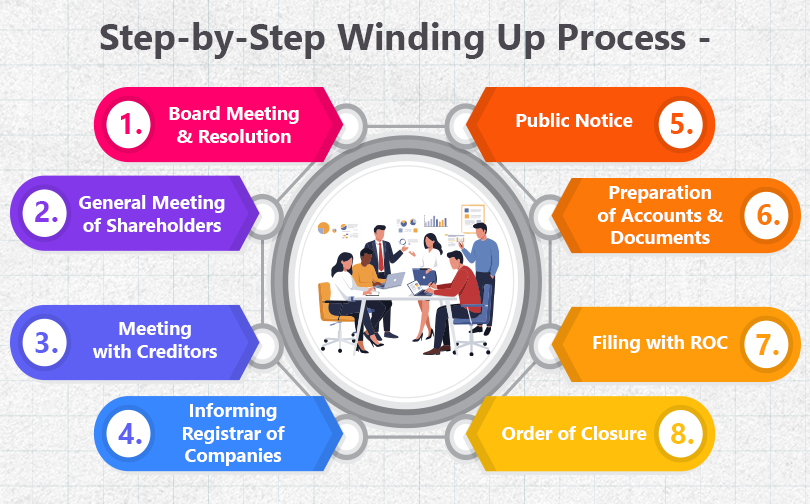

Step-by-Step Company Winding Up Process:

Every step of the closure of a company under the Companies Act 2013 involves compliance with Registrar of Companies (ROC) filings, resolutions, and public notices. The following is the step-by-step process:

- Board Meeting and Resolution: The directors convene a board meeting to pass a resolution proposing winding up, confirming whether the company is solvent or insolvent and planning debt settlement through asset sales if necessary.

- General Meeting of Shareholders: Within five weeks of the board meeting, a general meeting is called. Shareholders pass an ordinary or special resolution to approve the winding up.

- Meeting with Creditors: A meeting with creditors is held to obtain their consent, with at least two-thirds approval needed to proceed.

- Informing Registrar of Companies (ROC): Within 10 days after passing the winding-up resolution, the company informs the ROC and requests the appointment of an official liquidator.

- Public Notice: A notice of winding up is published both in the Official Gazette and a widely read local newspaper within 14 days.

- Preparation of Accounts and Documents: Within 30 days of the resolution, the company prepares affidavits, statements of assets, liabilities, share capital, profits, and debts. A special resolution is passed regarding disposal of accounts.

- Filing with ROC: Within 30 days after the final resolution, documents including accounts and the resolution are filed with the ROC.

- Order of Closure: The ROC reviews the filings and, if satisfied, issues an order for company closure within 60 days.

Know More About: Company Registration Services in Delhi India

Role of Creditors and Employees in Closure:

The roles of creditors and employees in the Private Limited Company Closure in India are crucial and defined by law:

Role of creditors:- Creditors are informed and consulted during the winding-up process, particularly in voluntary winding-up, where their approval of the resolution to wind up the company is required.

- Creditors hold meetings where they discuss and approve resolutions related to the winding up; they also nominate and approve the appointment of a liquidator who manages asset realization and debt payment.

- The liquidator values, recovers, sells, and realizes company assets and uses the proceeds primarily to repay creditors in a structured and transparent manner, ensuring equitable treatment as per the Insolvency and Bankruptcy Code (IBC), 2016.

- Creditors' rights are protected during the winding-up process, and they can initiate compulsory winding up if the company fails to pay dues. Their collective decisions guide asset distribution and company dissolution.

- Employees are recognized as stakeholders and typically have claims on unpaid wages or dues during the liquidation process.

- Outstanding employee benefits, salaries, or dues are prioritized for payment from company assets before distribution to shareholders, as per company law and insolvency regulations.

- Employees should be informed about the winding-up process, and their legal rights, such as provident fund, gratuity, and other benefits, must be settled during the closure.

- The liquidator ensures compliance with employment law, and employees may be entitled to compensation if the company is insolvent or under liquidation.

Together, creditors and employees shape and influence the winding-up process to safeguard their financial interests and ensure orderly closure of the company according to legal mandates.

Fast Track Exit (FTE) Scheme: Strike Off Private Limited Company under MCA:The Fast Track Exit (FTE) Scheme is a simplified, quick, and cost-effective method introduced by the Ministry of Corporate Affairs (MCA) in India to facilitate the closure of defunct or non-operational companies, including Private Limited Companies

Key features of the Fast Track Exit (FTE) Scheme:- The scheme is designed for companies that have no assets or liabilities and have been either inactive since incorporation or have not carried out any business activity for at least one year before applying.

- It provides an alternative to the traditional, often lengthy and complex winding-up process.

- Companies must not be listed, under investigation, have outstanding loans/dues, or be involved in any prosecution or legal disputes to qualify.

- The process is governed under Section 248 of the Companies Act, 2013, with the Registrar of Companies (ROC) responsible for processing applications through a centralized body called C-PACE (Centre for Processing Accelerated Corporate Exit).

- A board resolution is passed to approve the closure and authorize filing the strike-off application.

- Prepare an indemnity bond, an affidavit, and a statement of assets and liabilities, all confirming that there are no assets or liabilities.

- Filing Form STK-2 online with the ROC along with documents and a prescribed fee.

- The ROC examines the application, issues a public notice, and provides a 30-day window for objections.

- If no objections arise, the ROC strikes off the company’s name from the register, thereby dissolving it legally.

Timeframe and Cost Involved in Company Winding Up Process:

Timeframe:- The timeframe for the closure of a company under the Companies Act 2013 generally ranges from 6 to 12 months depending on the method used.

- After the winding-up, various statutory procedures must be completed, including informing the Registrar of Companies (ROC), publishing notices in the official gazette and newspapers, holding meetings with creditors and shareholders, and filling necessary documents within prescribed timelines.

- The ROC typically issues the final order for company dissolution within 60 days once all paperwork is complete and there are no objections.

- Compulsory winding up through the National Company Law Tribunal (NCLT) may take longer, often extending beyond 12 months depending on legal complexities and court proceedings.

- Summary or fast-track winding up may be quicker, but still may take several months for formal closure.

The cost varies depending on the mode of winding up, size, and complexity of the company; major expenses include:

- Liquidator fees (if appointed), which depend on the assets and workload.

- ROC filing fees and stamp duties for resolutions and affidavits.

- Legal and professional fees for company secretaries, chartered accountants, or lawyers assisting in the process.

- Advertisement costs for publishing public notices in newspapers and official gazettes.

Know More About: LLP Registration Services in Delhi India

Typically, the minimum filing and procedural fees can range from Rs 10000 to Rs 50000 or more, while comprehensive professional fees may cost significantly more based on company specifics and liquidator charges.

The cost for a strike-off of a Private Limited Company through the Fast Track Exit scheme is usually lower compared to full winding, around Rs 5000 to Rs 10000 in government fees, but excludes professional assistance.

Consequences of Non-Compliance in Company Closure:- Directors may get disqualified for up to 5 years under Section 164 of the Companies Act, 2013, preventing them from holding directorship in any company due to failure in compliance and filing requirements.

- The company and its directors can face heavy fines, including penalties for non-filing of annual returns or financial statements, plus daily fines accumulating up to lakhs. Delayed or false filings can attract fines and imprisonment from 6 months to 10 years, depending on the severity of non-compliance.

- Non-compliance may lead to prosecution, including possible imprisonment of directors or officers responsible for defaults in filing or fraud in submitted information.

- If a company is struck off without proper winding up, its assets may be seized and sold to settle outstanding dues, causing significant financial loss to shareholders and stakeholders.

- The company may continue to accrue statutory fees, taxes, penalties, and interest if not formally closed, increasing financial liabilities.

- Directors, shareholders, and employees can experience negative credit ratings, making it difficult to start or manage new businesses. The company’s reputation and trustworthiness can be severely damaged.

- Inactive companies not properly closed may have their bank accounts frozen by authorities, restricting financial operations.

Ensuring a smooth Private Limited Company Closure in India requires strict adherence to all legal and procedural compliances mandated under the Companies Act, 2013, and related regulations. Failure to follow proper procedures for the closure of a company under the Companies Act 2013 may result in penalties, director disqualification, and prosecution.

We assist private limited companies in smoothly closing their business by managing all legal compliances, resolving liabilities, preparing necessary documents, and filing applications with the Registrar of Companies (ROC). Our expert guidance ensures hassle-free and timely company closure, avoiding penalties and future liabilities.

Read Also:Frequently Asked Questions (FAQs) –

Q.1 What is the strike-off of a Private Limited Company?'Strike off' means removing the company’s name from the Registrar of Companies (RoC) records. It is the most common and cost-effective way to close a Private Limited Company under the Companies Act, 2013.

Q.2 Which forms are required for company closure?For strike-off, companies must file Form STK-2 with the RoC, along with necessary attachments like an indemnity bond, statement of accounts, and shareholder consent.

Q.3 How long does it take to close a Private Limited Company in India?The timeframe for the closure of a company generally ranges from 6 to 12 months depending on the method used.

Q.4 What happens if a company does not close properly?If a company is not officially closed, it will continue to be liable for annual compliance, late filing penalties, and possible prosecution under the Companies Act, 2013.

Q.5 What is the Fast Track Exit (FTE) Scheme?The Fast Track Exit (FTE) Scheme is a simplified, quick, and cost-effective method introduced by the Ministry of Corporate Affairs (MCA) in India to facilitate the closure of defunct or non-operational companies.