Subsidiary Company Formation in India: Opportunities for Foreign Investors

Gateway to India’s Growth: Why Foreign Investors Choose Subsidiaries

India’s dynamic economy, business-friendly policies, and vast market have positioned it as a prime destination for foreign investors seeking growth through subsidiary company formation. Establishing a subsidiary company in India through the process of subsidiary company formation in India offers multinational enterprises unmatched access to over 1.4 billion consumers, robust supply chains, and a fast-growing digital ecosystem. The process is streamlined by digital government portals and guided by the Companies Act, 2013 subsidiary rules, ensuring regulatory clarity and ease of entry for foreign entities.

Subsidiaries can be either wholly owned or majority-owned by the parent company, allowing global firms to maintain control while leveraging India’s local business benefits. With simplified compliance requirements, access to skilled talent, and a growing innovation-driven market, forming a subsidiary in India enables foreign companies to expand efficiently and profitably, positioning them to tap into the nation’s economic transformation and ongoing reforms.

What is a Subsidiary Company in IndiaA subsidiary company in India is a distinct legal entity that is controlled by another company, known as the parent or holding company. Control is established when the parent company owns more than 50% of the subsidiary’s total share capital, either directly or through other subsidiaries. Subsidiaries can be wholly owned (100% owned by the parent company) or majority owned (over 50% ownership, with other shareholders).

Though a foreign subsidiary in India operates independently, it benefits from the parent company’s resources, brand, and strategic direction. Legally, a subsidiary can enter into contracts, own assets, and be sued or sue separately from the parent, ensuring limited liability and risk containment for the parent company. In India, subsidiaries are governed by the Companies Act, 2013, and must comply with local laws and FDI regulations, offering foreign companies a pathway to expand locally while maintaining control over operations.

Types of Subsidiary Companies for Foreign Investors

Foreign investors can choose between two types of subsidiaries – a wholly owned subsidiary in India and a partially owned foreign subsidiary in India:

- Wholly Owned Subsidiary (WOS): In a wholly owned subsidiary in India, the foreign parent company owns 100% of the subsidiary’s shares. This type is allowed in sectors where 100% FDI in Indian subsidiaries is permitted under the automatic route. It offers complete ownership and control to the foreign company, allowing it to make independent strategic decisions without needing consent from other shareholders.

- Partially Owned Subsidiary (Majority-Owned Subsidiary): In a partially owned subsidiary in India, the foreign parent company holds more than 50% but less than 100% of the shares, while the rest are owned by Indian partners or investors. This is common in sectors with FDI limits or regulatory caps where foreign ownership cannot be 100%. The foreign company maintains majority control but collaborates with local shareholders, balancing control with local expertise and compliance.

These types allow foreign investors to choose the level of ownership and control based on sector-specific regulations, business goals, and market-entry strategies, providing flexibility for expanding in India’s diverse economic landscape.

Legal Framework Governing Subsidiary FormationThe legal framework governing subsidiary formation in India is primarily framed under the Companies Act, 2013. According to Section 2(87) of the Act, a subsidiary company is defined as a company in which the holding or parent company:

- Controls the composition of the board of directors, or

- Owns or controls more than 50% of the total share capital, either directly or through subsidiaries.

The Act establishes subsidiaries as separate legal entities distinct from their parent companies, thereby limiting the liability of the parent company to its investment in the subsidiary. It mandates that every subsidiary must have at least one director who is a resident of India, ensuring local governance standards.

Key provisions under this framework include:- Procedures for incorporation and registration of subsidiaries through the Ministry of Corporate Affairs (MCA).

- Financial reporting and audit requirements to ensure transparency and accountability, with subsidiaries required to submit their financial statements to parent companies.

- Governance requirements, allowing parent companies to appoint the majority of the board but requiring at least one Indian resident director.

- Restrictions on subsidiary investments in parent companies or related entities to prevent conflicts of interest.

- Coverage of mergers, amalgamations, and related party transactions under applicable laws.

Know More About: One Person Company (OPC) Registration Services

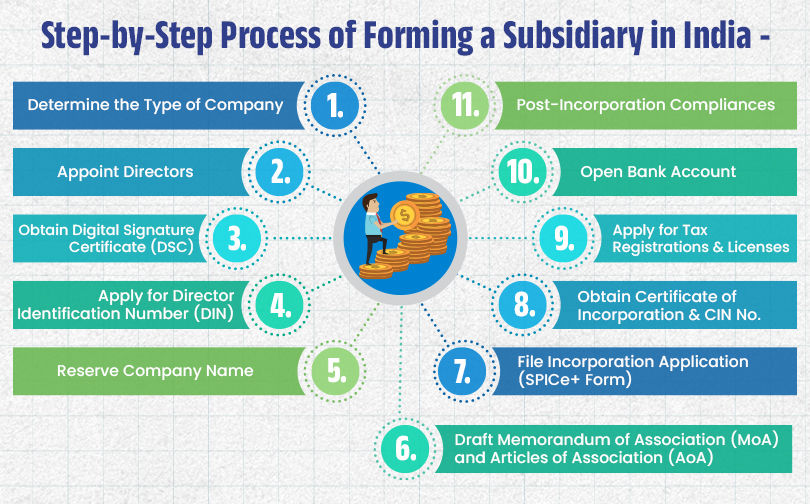

Step-by-Step Process of Registering a Foreign Subsidiary in India

The step-by-step process of forming a subsidiary company in India is as follows:

- Determine the Type of Company: Decide whether to form a private limited company (common for subsidiaries) or a public limited company based on business needs and regulatory requirements.

- Appoint Directors: A minimum of two directors is required, with at least one being an Indian resident or citizen to comply with Indian corporate law.

- Obtain Digital Signature Certificate (DSC): Directors need to obtain a DIN, a unique ID required to act as directors in Indian companies.

- Apply for Director Identification Number (DIN): Directors need to obtain a DIN, a unique ID required to act as directors in Indian companies.

- Reserve Company Name: Apply for name approval through the MCA’s SPICe+ portal. The name can reflect the parent company, with India added. The name is reserved for 20 days, extendable if required.

- Draft Memorandum of Association (MoA) and Articles of Association (AoA): These key documents define the company’s scope, activities, governance rules, and operational framework.

- File Incorporation Application (SPICe+ Form): Submit the SPICe+ (Simplified Proforma for Incorporating Company electronically) form online along with MoA, AoA, DIN, DSC, and other required documents to the Registrar of Companies (RoC).

- Obtain Certificate of Incorporation and Corporate Identity Number (CIN): After verification, the RoC issues the Certificate of Incorporation and CIN, recognizing the legal existence of the subsidiary.

- Apply for Tax Registrations and Licenses: Obtain Permanent Account Number (PAN), Tax Deduction and Collection Account Number (TAN), Goods and Services Tax (GST) registration, and other necessary licenses or registrations to comply with Indian tax laws.

- Open Bank Account: Open a corporate bank account in the subsidiary’s name to conduct financial transactions.

- Post-Incorporation Compliances: Hold the first board meeting, appoint auditors, issue share certificates, and ensure compliance with ongoing regulatory requirements.

Key Compliance Obligations for Subsidiaries in India

- Board Meetings and Corporate Governance: Subsidiaries must hold at least four board meetings annually, with the first board meeting within 30 days of incorporation. Annual General Meetings (AGMs) must be held once every year, with minutes properly recorded and filed with the Registrar of Companies (RoC).

- Financial Reporting and Audits: Subsidiaries are required to maintain books of accounts as per Indian accounting standards and conduct statutory audits annually by a qualified Chartered Accountant. Tax audits must also be conducted if turnover exceeds the specified limits. Annual financial statements must be filed with the RoC.

- Tax Registrations and Filings: Subsidiaries must obtain and maintain PAN, TAN, and Goods and Services Tax (GST) and comply with regular GST filings (GSTR-1, GSTR-3B, and GSTR-9). Income tax returns, tax audits, and tax deduction at source (TDS) compliance mandatory.

- Foreign Exchange Reporting: Reporting to the Reserve Bank of India (RBI) is required through forms such as FC-GPR (Foreign Currency Gross Provisional Return) within 30 days of receiving capital remittance and annual Form FLA (Foreign Liabilities and Assets) detailing foreign investment inflows and outflows.

- Statutory Filings with RoC: These include appointing auditors, filling annual returns (MGT-7), financial statements (AOC-4), directors’ disclosures (MBP-1), share capital filings (DPT-3), and updating directors’ KYC.

- Licenses and Local Compliance: Depending on business activity, subsidiaries must obtain necessary licenses like the Importer Exporter Code (IEC) and Professional Tax registration and comply with labor laws, including employee provident fund (EPF) contributions.

- Event-Based Compliances: Event-driven filings include share transfers (FC-TRS), changes in directors or shareholding structure, and other regulatory updates as mandated by Indian law and RBI regulations.

Non-compliance with these obligations can result in fines, penalties, or operational restrictions. Meeting these compliance requirements ensures smooth functioning and legal standing of foreign subsidiaries in India.

Benefits of Setting Up a Subsidiary in IndiaSetting up a subsidiary in India offers numerous benefits for foreign investors, making it a strategic choice for market entry and business expansion:

- Subsidiary company formation in India provides direct access to the vast consumer base of over 1.4 billion people, enabling tailored products and services for local preferences.

- As a separate legal entity, the subsidiary limits the parent company’s liability to its investment, protecting parent assets from local business risks.

- The parent company retains control over the subsidiary’s strategic and operational decisions, allowing quick responses to local market dynamics while benefiting from local management.

- Subsidiaries can avail themselves of various tax incentives, including tax holidays in certain sectors, deductions for research and development, and consolidated tax filings with the parent company to optimize tax liabilities.

- India’s large pool of skilled, English-speaking professionals provides cost-effective talent for technology, engineering, finance, and other sectors.

- India’s improving ease of doing business, supported by clear laws and government reforms, facilitates smooth incorporation and ongoing compliance.

- Being locally incorporated boosts credibility with customers, suppliers, and regulators, signaling a firm commitment to the Indian market.

- Lower labor and operational costs compared to many developed economies make India an attractive manufacturing and service hub.

- Subsidiaries can form local alliances and joint ventures that enhance market penetration and distribution networks.

Challenges Faced by Foreign Subsidiaries in India

Foreign subsidiaries in India face several challenges despite the opportunities available. Key challenges include:

- India’s legal and regulatory environment is intricate, with frequent changes in laws and multiple layers of central and state regulations.

- Foreign subsidiaries must navigate complex Foreign Direct Investment (FDI) policies, sector-specific caps, licensing requirements, and labor laws, which can be time-consuming and require local expertise.

- Managing diverse tax obligations such as corporate tax, Goods and Services Tax (GST), Transfer Pricing regulations, and Tax Deducted at Source (TDS) can be cumbersome.

- Obtaining necessary licenses, environmental clearances, and approvals from various governmental agencies can be slow and bureaucratic, delaying operations and increasing costs.

- Stringent and varying labor regulations across states impose compliance burdens, posing risks of labor disputes and operational disruptions.

- Lengthy legal procedures and court backlogs delay contract enforcement and dispute resolution, impacting business certainty.

- Understanding local consumer behavior, language barriers, and regional market dynamics requires adaptation. Intense competition from well-established local players also poses strategic challenges.

- While improving, infrastructure gaps and variable operational costs can impact business efficiency and supply chain management.

Emerging opportunities for foreign investors in India span several high-growth sectors. The electrical vehicle (EV) and clean technology market is rapidly expanding, supported by government incentives and global suppliers and growing healthcare demand. Information technology, AI, fintech, and digital services offer immense potential due to a robust startup ecosystem and skilled talent pool. Space and satellite manufacturing are opening up with significant FDI liberalization. Renewable energy and green hydrogen sectors are gaining momentum, driven by ambitious national targets and policy support. These sectors collectively offer vibrant growth and investment prospects.

Government Initiatives Supporting Foreign Subsidiaries

Key government initiatives supporting foreign subsidiaries in India are:

- The Ministry of Corporate Affairs (MCA) provides an online single-window SPICe+ portal for quick and easy subsidiary registration.

- Most sectors permit 100% FDI under the automated route, reducing bureaucratic hurdles and easing foreign ownership.

- Various tax breaks, tax holidays, and production-linked incentive (PLI) schemes promote sectors like manufacturing, technology, renewables, and pharmaceuticals.

- Subsidiaries can operate in SEZs and International Financial Services Centres, offering tax exemptions, relaxed regulations, and infrastructure benefits.

- Encourages states to compete for investments by improving infrastructure, logistics, and policy environment.

- Digital transformation of government services accelerates approvals, licenses, and compliance procedures for subsidiaries.

- Increased FDI caps in sectors like insurance (raised to 100%), telecom, defense, space, and renewable energy open up new opportunities for foreign subsidiaries.

Registering a subsidiary company in India offers foreign investors a strategic gateway to tap into one of the world’s fastest-growing markets, backed by a stable and business-friendly regulatory environment. Subsidiaries benefit from limited liability protection, operational autonomy, and access to a vast, skilled workforce. India’s favorable tax regime, government initiatives, and growing consumer base make it an ideal base for sustainable growth and innovation.

By localizing operations through a subsidiary, foreign companies can effectively align with market demands, build credibility, and unlock long-term value in India’s dynamic economy, establishing a strong foundation for global expansion. Subsidiary company formation in India is one of the most effective strategies for foreign investors to enter and expand in the Indian market.

We assist foreign businesses in seamlessly registering subsidiary companies in India, handling everything from company name reservation and director documentation to filing incorporation forms with the Registrar of Companies. Our expert support ensures quick compliance with all regulatory requirements, enabling your subsidiary to start operations smoothly and efficiently.

Read Also:DIR-3 KYC Form: Complete Guide for Directors in India

Frequently Asked Questions (FAQs) –

Q.1 What is a subsidiary company in India?A subsidiary company in India is a separate legal entity controlled by a foreign or domestic parent company, where the parent holds more than 50% of the share capital or controls the board of directors.

Q.2 Can a foreign company open a subsidiary in India?Yes, foreign companies can establish subsidiaries in India under the Companies Act, 2013, and the Foreign Direct Investment (FDI) policy.

Q.3 What are the types of subsidiaries available for foreign companies in India?Foreign companies can establish a Wholly Owned Subsidiary (WOS)—100% owned where 100% FDI is allowed. Partially Owned Subsidiary – More than 50% but less than 100% ownership.

Q.4 What laws govern subsidiary company formation in India?Subsidiaries are governed by the Companies Act, 2013, FDI regulations, Reserve Bank of India (RBI) guidelines, and other sector-specific laws.

Q.5 What is the minimum requirement to register a foreign subsidiary in India?At least two directors are required, with one being an Indian resident. The company must also have a registered office in India, approved MoA & AoA, and comply with MCA registration norms.